Shale gas and 'fracking' may be tangled up with concerns over dirtying water supplies and making the earth shake in the minds of most. But the boom in shale gas, forced out using hydraulic fracturing (or fracking), has had some other big knock-ons too. The vast increase in shale gas being pumped out in the US has caused gas prices to plummet; prices recently hit a low of $2.50 per 1000 cft (cubic feet). Surely a cheap energy prize for all? Not necessarily, that flood of cheap gas may be turn out to be anything but a boon.

Fracking for shale gas could is undermining the fragile shoots of the renewable energy industry, according to some observers as it is leaving solar and wind power uncompetitive. And shale gas may actually be doing something of a hit-and-run on US energy scene. US agencies have recently been rushing to slash forecast reserves, even as the short-term glut of gas wreaks havoc all round. Both these developments come against the background of growing worries over the impact of shale gas on climate change, which may be 'dirtier' than coal.

Renewables victims of hit-and-run: Shale gas has been a oft-touted 'clean bridge fuel to the future' recently, in recognition of its relatively low CO2 output, when burnt to produce energy. That claim hasn't just come from the shale gas industry. In his State of the Union address in January, President Obama said 'the development of natural gas will create jobs and power trucks and factories that are cleaner and cheaper, proving that we don't have to choose between our environment and our economy.'

Whilst those clean credentials are debatable-in-the-extreme thanks to mainly the neglected impact of methane leakage, such thinking has helped fuel a boom in drilling and fracking in the US over the last decade. As shale gas companies have competed for investment money, to frack in ever more areas, reserve numbers have swelled. And 'home-grown' shale gas has been marketed as a fuel that would guarantee energy security for decades. 'We have a supply of natural gas that can last America nearly 100 years,' said President Obama.

But the rush to pump out shale gas, as well as spilling problems into water courses across the country, has also left stocks of gas higher than ever, and the price drastically down. Whilst that is great news, short-term, for energy consumers, it is leaving the push to 'zero-carbon' renewables treading water. Rachel Cleetus, from the Union of Concerned Scientists, told the Washington Post last week that natural gas could 'take over the entire pie and crowd out renewables. Part of the reason this is happening is that there's a sense that natural gas resources will be around forever.' Which may be far from the case.

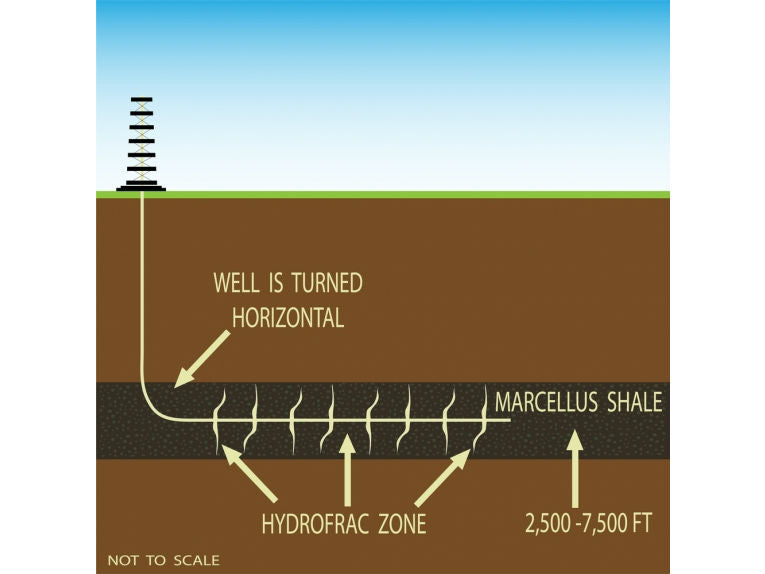

'100-year' reserves shrinking fast: First out the blocks was the U.S. Geological Survey, which said last summer that the Marcellus Shale formation, the gigantic mother-lode formation for shale gas in the US, could hold as little as 20% of its first estimate of unrecovered gas. Then, in the last 2 weeks, the US Energy Department followed suit, cutting its recoverable reserves estimate for the same formation from 410 trillion cubic feet (tcf), to a little over 140 tcf. And the total US potential shale gas production was nearly halved in the same report.

One of the problems of fracking to produce shale gas is that it is a relatively new technology. So predictions of what is likely to be produced are just that. And so far those predictions have only been revised dramatically down. If shale gas turns out to provide only a temporary boost to the nation's energy supply and moreover one that pollutes the planet as much as it does local water supplies, it could prove to be a damaging detour.

With investment wasted in chasing a fuel with few environmental benefits and which has helped to forestall the much-needed rush into truly renewable fuels the shale gas bridge may turn out to be a road to nowhere.